refinance transfer taxes new york

Rather than the Seller paying transfer tax on the full sale price the transfer tax is the sale price less the amount of the mortgage obtained by Buyer. In NYC this tax ranges from 18 1925 of the.

Closing Costs That Are And Aren T Tax Deductible Lendingtree

The average 30-year fixed-refinance rate is 553 percent up 9 basis points compared with a week ago.

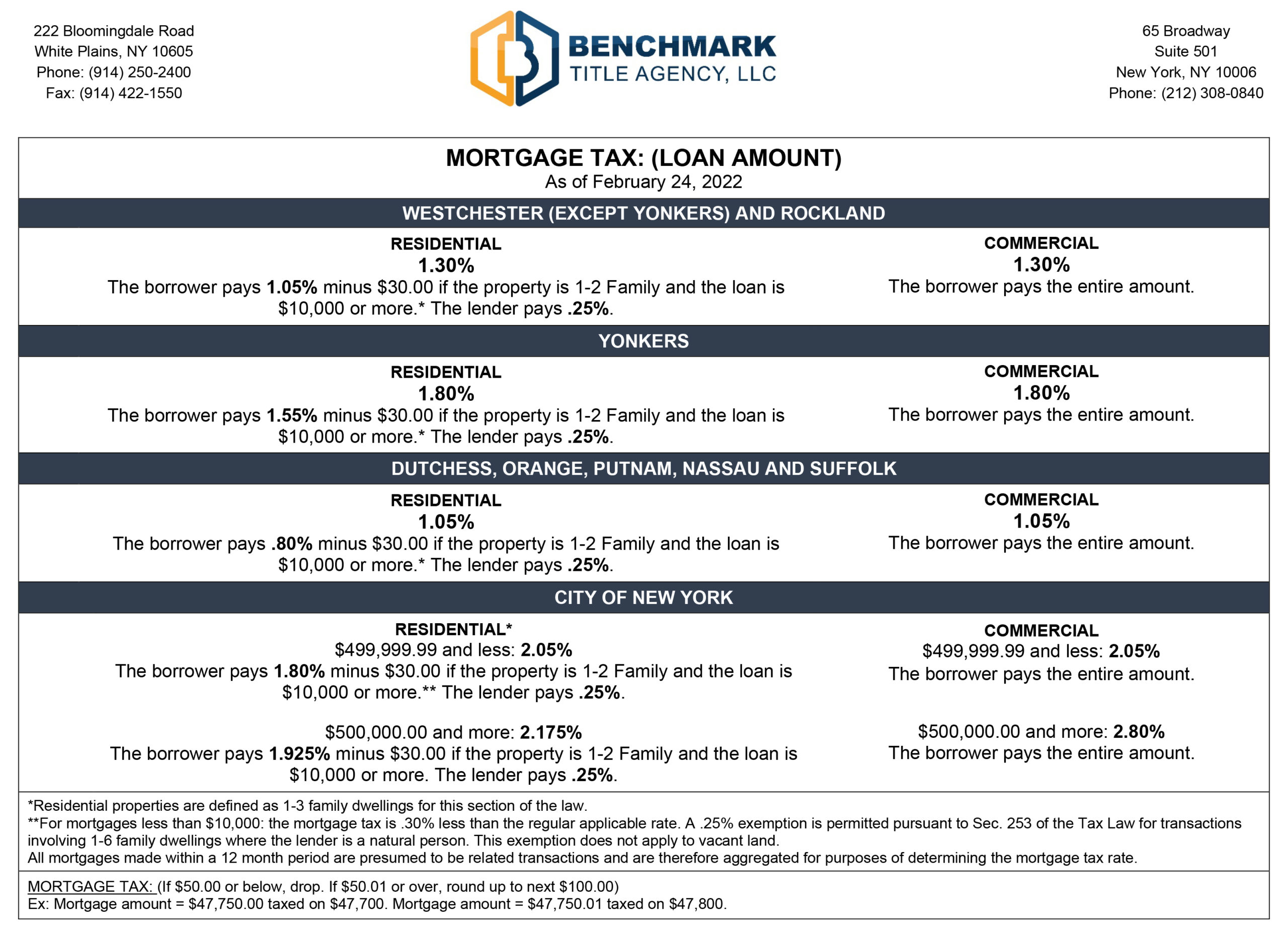

. In NYC the mortgage recording tax ranges from 18 1925 of the mortgage amount. Will refinancing to a new ARM or a fixed-rate. A month ago the average rate on a 30-year fixed.

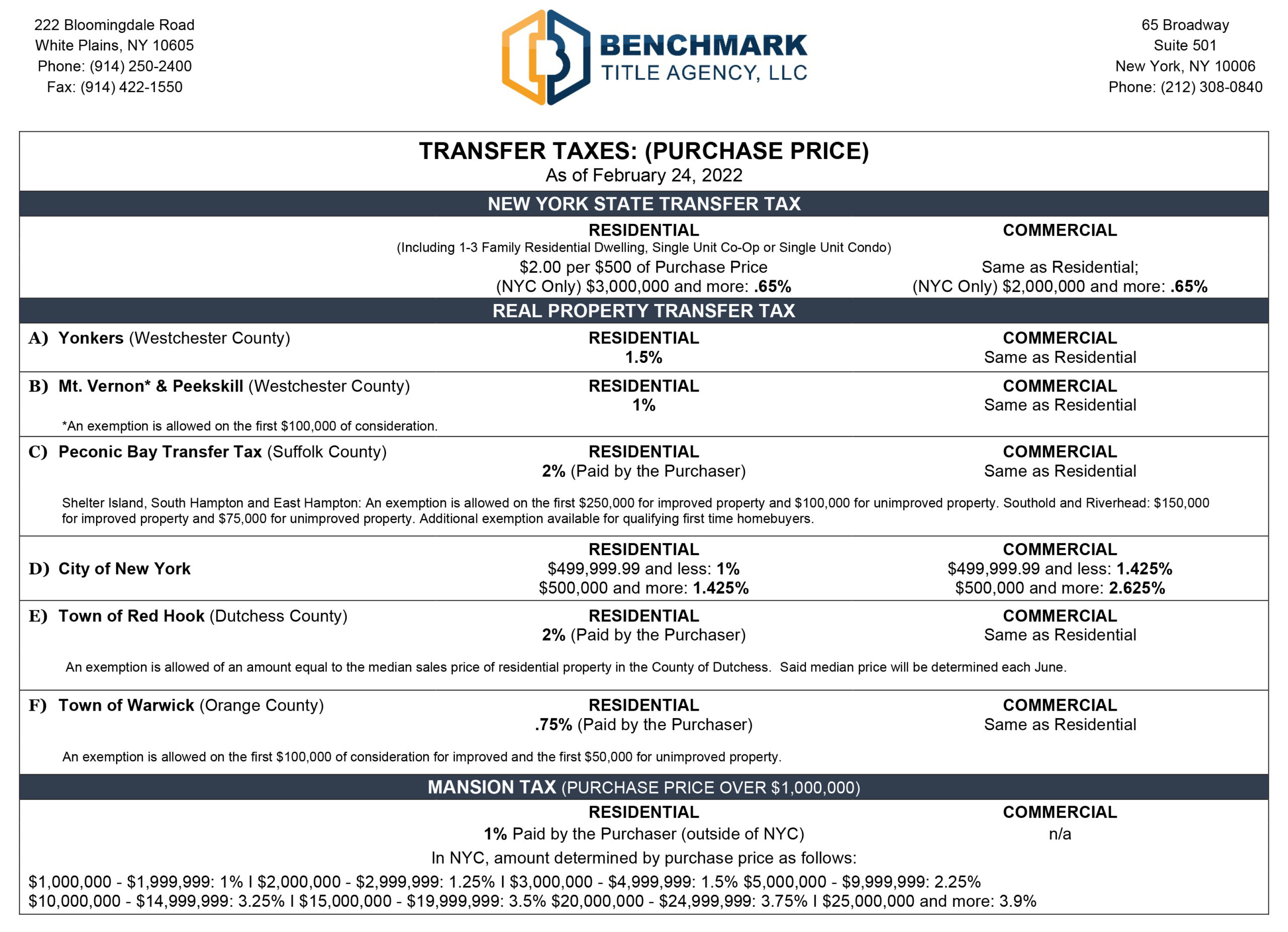

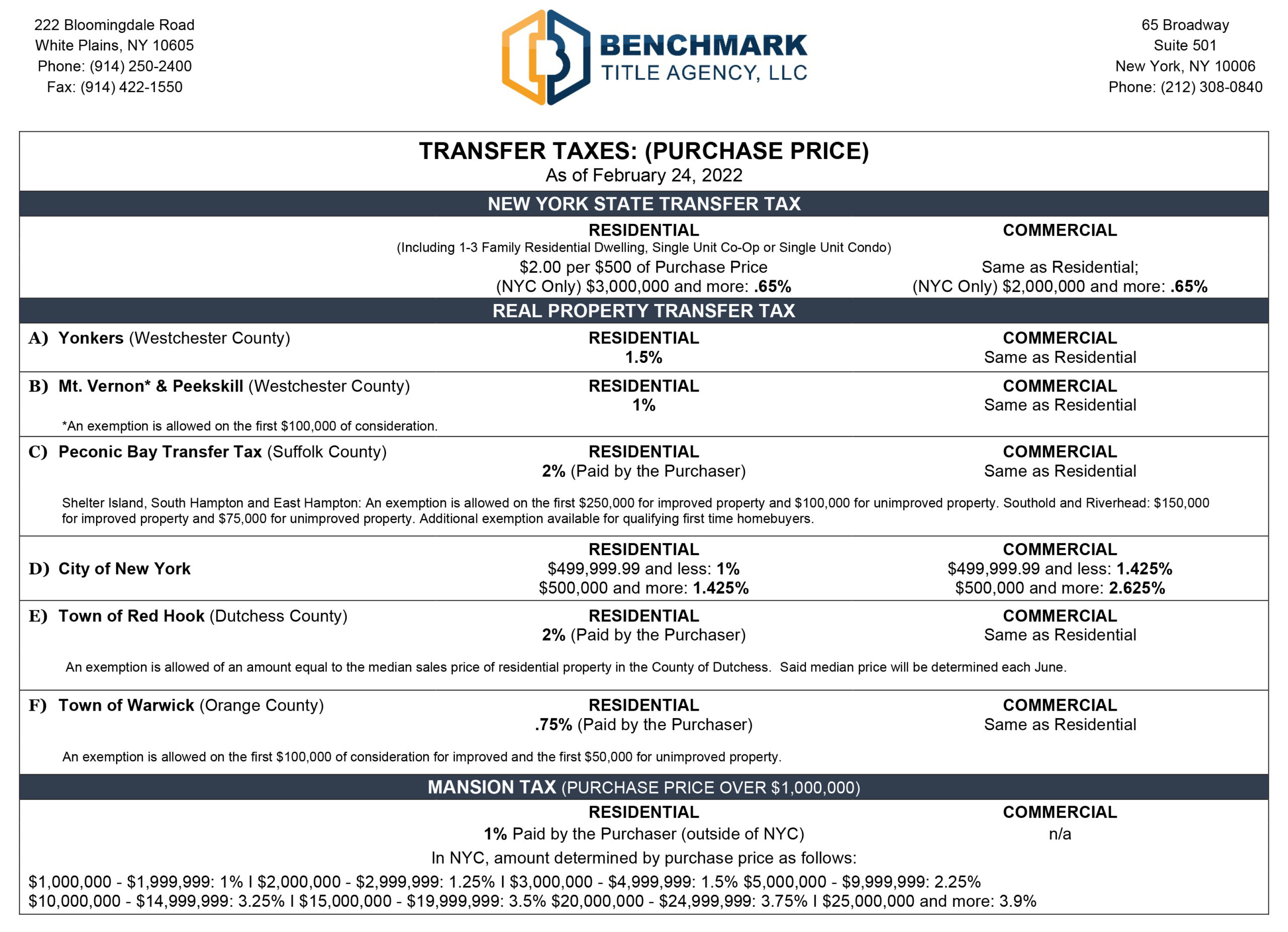

For instance the real estate transfer tax would come to 1200 for a 300000 home. Real Property Transfer Tax Filing Extensions and the COVID-19 Outbreak. The higher rate of 065 kicks-in at a lower threshold of 2 million.

Generally transfer taxes are paid when property is transferred between two parties and a deed is recorded. You can qualify for a streamline FHA refinance if youre up-to-date on your current mortgage and its already insured by the FHA. New York City Property Original Mortgage.

Yet they may end up doing so if their. The New York State transfer tax rate is. This tax is levied on both home purchases and mortgage refinances which means you.

It applies to all residential. Pickup or payoff fee. 50000 Lender Doesnt Pay any of the Mortgage Tax CEMA Recorded Mortgage.

600 Third Avenue 2nd Floor New York NY 10016. The NYC transfer tax rate is between 1 and 1425 depending on the sale price. New York homeowners looking to refinance an existing mortgage dont have to pay the states mortgage recording tax all over again.

In addition to what. The tax must be paid again when refinancing unless both the old lender and the new lender accept the Consolidation Extension Modification Agreement CEMA process. Properties with sales prices of 1 million or.

In a refinance transaction where property is not. You can make sure the seller understands that they will likewise be saving for them as well because they will have reduced New York State transfer taxes which are typically 04. 700000 Refinance Loan Amount.

Transfer tax on refinance in new york. Basic tax of 50 cents per 100 of mortgage debt or obligation secured. If the value of the property is 499999 or.

In resales the New York City real estate transfer tax formally known as the Real Property Transfer Tax RPTT is paid by the seller. Along with the state tax New York City Yonkers and several counties apply an additional local tax on recording a mortgage. An additional tax of.

So if you borrow 500000 or less you pay 18 percent of the loan as a tax. If you sell real property in New York City youll have to pay local and state transfer taxes. 780 Third Avenue 9th Floor New York City NY 10017 2124751040.

If a person is being added to the property deed at the time of refinancing then the person will have to pay the transfer taxes. But the most youll get back in cash is up to. Special additional tax of 25 cents per 100 of mortgage debt or obligation secured.

This last tax is calculated as a percentage of the mortgage not the purchase price. For example if you have a 200000 mortgage and are refinancing with a 300000 loan and live in New York City you would ordinarily have to pay a tax of 300000 x 18 percent. The Mortgage Recording Tax Rates in NYC are technically 205 for loan sizes below 500k and 2175 for loan sizes of 500k or more but the buyers lender typically pays.

13th Sep 2010 0328 am. New York State transfer tax. New York State equalization fee.

You must pay the Real Property Transfer Tax RPTT on sales grants assignments transfers or surrenders of real. The New York State Transfer Tax is 04 for sales below 3 million and 065 for sales of 3 million or more. New York State also has a mansion tax.

The NYC transfer tax formally known as the Real Property Transfer Tax RPTT must be paid whenever real estate transfers between two parties. 30-year fixed refinance.

Nyc Mansion Tax Of 1 To 3 9 2022 Overview And Faq Hauseit

Nyc Mansion Tax Of 1 To 3 9 2022 Overview And Faq Hauseit

Nyc Nys Seller Transfer Tax Of 1 4 To 2 075 Hauseit

Saving New York State Mortgage Recording Tax Gonchar Real Estate

The Complete Guide To The Nyc Mortgage Recording Tax Yoreevo Yoreevo

Mortgage Tax In Nyc Nestapple Biggest Commission Rebate

Mortgage Tax Transfer Tax Benchmark Title Agency Llc

Mortgage Tax Transfer Tax Benchmark Title Agency Llc

Nyc Nys Transfer Tax Calculator For Sellers Hauseit

Nyc Nys Seller Transfer Tax Of 1 4 To 2 075 Hauseit

Refinancing Your House How A Cema Mortgage Can Help

Mansion Tax Nyc Everything You Need To Know Yoreevo Yoreevo

Nyc Nys Seller Transfer Tax Of 1 4 To 2 075 Hauseit

What Are Real Estate Transfer Taxes Forbes Advisor

Reducing Refinancing Expenses The New York Times

Nyc Nys Seller Transfer Tax Of 1 4 To 2 075 Hauseit

Nyc Mortgage Recording Tax Of 1 8 To 1 925 2022 Hauseit

The Mortgage Recording Tax In Nyc Explained By Hauseit Medium